Axis Small Cap Fund - Regular Plan - Growth

Fund House: Axis Mutual Fund| Category: Equity: Small Cap |

| Launch Date: 05-11-2013 |

| Asset Class: Equity |

| Benchmark: NIFTY Smallcap 250 TRI |

| TER: 1.59% As on (28-11-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 100.0 |

| Minimum Topup: 100.0 |

| Total Assets: 26,838.22 Cr As on 28-11-2025(Source:AMFI) |

| Turn over: 28% | Exit Load: If redeemed / switched-out within 12 months from the date of allotment:For 10% of investments: NIL on FIFO basis For remaining investments: 1% w.e.f., 29/11/2018 |

105.63

-0.59 (-0.5586%)

21.46%

Benchmark: 15.87%

PERFORMANCE

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Investment Objective

To generate long-term capital appreciation from a diversified portfolio of predominantly equity & equity related instruments of small cap companies.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 14.35 |

| Sharpe Ratio | 0.84 |

| Alpha | 1.26 |

| Beta | 0.7 |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| Axis Small Cap Fund - Regular Plan - Growth | 05-11-2013 | -0.13 | 10.64 | 18.64 | 21.24 | 17.81 |

| QUANTUM SMALL CAP FUND - REGULAR PLAN GROWTH OPTION | 05-11-2023 | 7.2 | 9.49 | - | - | - |

| Sundaram Small Cap Fund Regular Plan - Growth | 10-02-2005 | 2.86 | 9.16 | 20.8 | 21.95 | 13.68 |

| BANDHAN SMALL CAP FUND - REGULAR PLAN GROWTH | 08-02-2020 | 2.18 | 18.46 | 30.67 | 25.35 | - |

| ICICI Prudential Smallcap Fund - Growth | 01-10-2007 | 1.46 | 6.74 | 17.09 | 21.37 | 15.85 |

| HDFC Small Cap Fund - Growth Option | 02-04-2008 | 1.19 | 8.9 | 20.41 | 24.07 | 17.7 |

| PGIM India Small Cap Fund - Regular Plan - Growth Option | 29-07-2021 | 0.82 | 8.58 | 14.09 | - | - |

| TRUSTMF SMALL CAP FUND -REGULAR PLAN-GROWTH | 04-11-2024 | 0.28 | - | - | - | - |

| DSP Small Cap Fund - Regular - Growth | 15-06-2007 | 0.16 | 10.58 | 20.48 | 22.12 | 16.11 |

| Mahindra Manulife Small Cap Fund - Regular Plan - Growth | 05-12-2022 | 0.09 | 10.21 | 25.25 | - | - |

Scheme Characteristics

Minimum investment in equity & equity related instruments of small cap companies - 65% of total assets.

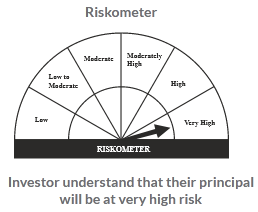

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

67.54%

Others

8.14%

Large Cap

5.87%

Mid Cap

18.47%

Scheme Documents

There are no scheme documents available